The end of summer is an important time for the online gambling industry. From late spring until at least July, revenue tends to be on the decline or at least growing more slowly in the case of a budding market.

Part of this has to do with the season itself. People are outdoors more, perhaps off on vacation. They have other things to do than gamble on their phones. There are also seasonal effects on the crossover from companies’ sportsbooks. Mid-summer, there’s comparatively little to bet on, but the return of the NFL also means the return of sports bettors.

The seasonal recovery started early this year. September is a consistently big month, but August can go either way. This year, Michigan, Pennsylvania, Connecticut, West Virginia and Delaware all saw online casino revenue growth last month. But not New Jersey. Why not?

Data for this article comes from the New Jersey Division of Gaming Enforcement.

August by the Numbers in New Jersey

New Jersey online casinos brought in $129,231,530 for August, compared to $134,424,044 the month before. That’s a drop of 3.9%. Online poker rooms contributed an additional $2,206,653, also down 3.1% relative to July.

All told, gross iGaming revenue for NJ in August amounted to $131,438,183.

Looking at where that revenue is coming from gives us some clues as to why it was a bad month for the state. Of the eight licenses, five had slightly positive months. It was, therefore, only three licenses dragging the market down:

- Borgata: -2.7%

- Golden Nugget: -9.1%

- Caesars: -18.5%

Borgata‘s loss is slight and could be down to random variance. Even so, it had a significant impact because Borgata is the market leader, accounting for over 30% of all revenue most months.

On the other hand, Golden Nugget traditionally has a poor showing in August. It’s one of the original New Jersey online casino sites and, since 2014, has almost performed worse than the market average in August, by an average of a whopping ten percentage points. In other words, a 9.1% loss is actually pretty typical for that license.

Looking in from the outside, it’s hard to know why that is, but it’s a pretty consistent trend. 2016 was the only year it had a better month than the average competitor. Our best guess would be that it has something to do with the company’s marketing strategy, perhaps waiting a bit later in the year than most to start its fall push.

The drop for Caesars is even more dramatic. It’s also more explainable. Much of its August loss amounts to the site coming down from a very strong July. Its daily average online casino revenue was up 14.1% that month when aggregate revenue for its competitors had fallen 1.7%.

Caesars and the WSOP Online Hangover

The unusually good July and subsequent drop in August are likely due to online bracelet events at WSOP.com. These took place in June while the live World Series of Poker played out in Las Vegas.

The unusually good July and subsequent drop in August are likely due to online bracelet events at WSOP.com. These took place in June while the live World Series of Poker played out in Las Vegas.

These are the most popular online tournaments of the year in the US, and their immediate impact on poker revenue is dramatic. This year’s was less so because of the competition with the live WSOP, which took place at a different time in 2021 and not at all in 2020. Even so, it was a 15% increase in June, which is still significant, especially since its competitors both saw revenue drop that month.

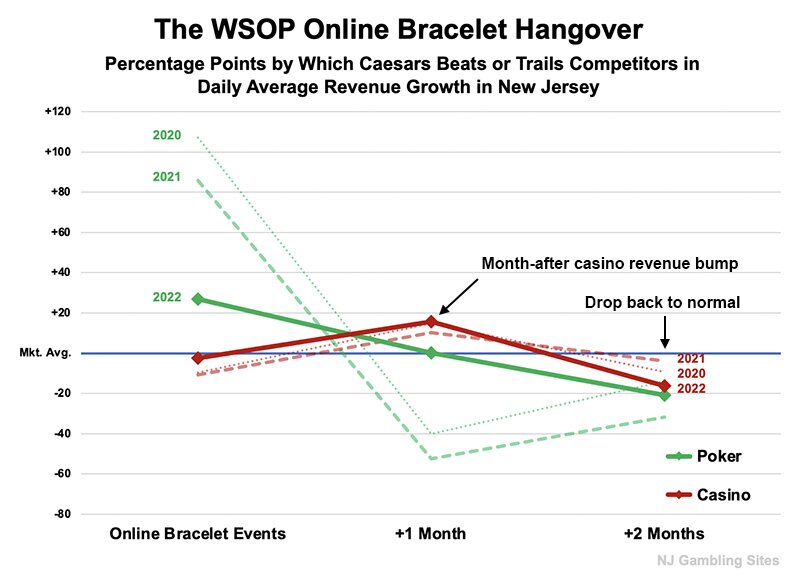

Less obvious is that these online bracelet series have had a smaller but equally consistent impact on casino revenue the following month. Comparing Caesars to the combined growth of its competitors to account for seasonal effects, it beat other licenses by 15.8 percentage points in 2020, 10.2 in 2021 and 14.9 in 2024, in the month immediately following the online bracelets.

There are two intuitive explanations for this, with the reality probably being a combination of them:

- New players signing up to play for WSOP bracelets and sticking around for a while after the series to play casino games

- Players who cashed during the series taking their money to the casino to try to run it up some more

As consistent as that performance is, it has also been consistently short-lived. The second month following the online bracelets has always been just as sharply down, and this August was no exception.

The graph above shows how Caesars over- or under-performs its competitors in each vertical during the month when the online bracelet events occur and each of the following two months.